According to Gaw NP Industrial, Vietnam is expected to continue to advance the value chain thanks to stable growth, favorable business environment, free trade agreements and the trend of shifting supply chains away from China. Experts expect some trend forecasts to continue to be clearer in 2022 and the coming years.

In a recent announcement, Gaw NP Industrial announced its goal to expand its land bank up to 100 hectares in 2022. Currently, the company has a scale of more than 49 hectares of land ready-built factory (RBF) and ready-built warehouse. (RBW) rental.

Appreciating the growth potential of the Vietnamese market, Gaw Capital Partners and NP Capital Partners Company launched Gaw NP Industrial – a $200 million industrial real estate investment fund. Although just established, Gaw NP Industrial continuously expands its investment. At the end of last year, the fund started construction of a ready-built factory project at GNP Yen Binh 2 Industrial Center (Thai Nguyen) with an area of 16ha, after putting into operation GNP Yen Binh 1 project, with a total area of 13ha. The investor said that the project was 100% fully filled before construction was completed in June.

In early 2022, Gaw NP Industrial continues to invest in a factory in Hai Phong, Nghe An. Although it is not possible to share project details, the fund’s representative, Mr. Vo Sy Nhan, General Director of Gaw NP Industrial, revealed that one of the new projects will have an area of phase 1 of 15 hectares, phase 2 as planned. expanded by 15ha and deployed in early 2023.

According to him, Vietnam is expected to continue to advance the value chain thanks to stable growth, a favorable business environment, free trade agreements and the trend of shifting supply chains away from China. Experts expect some trend forecasts to continue to be clearer in 2022 and the coming years.

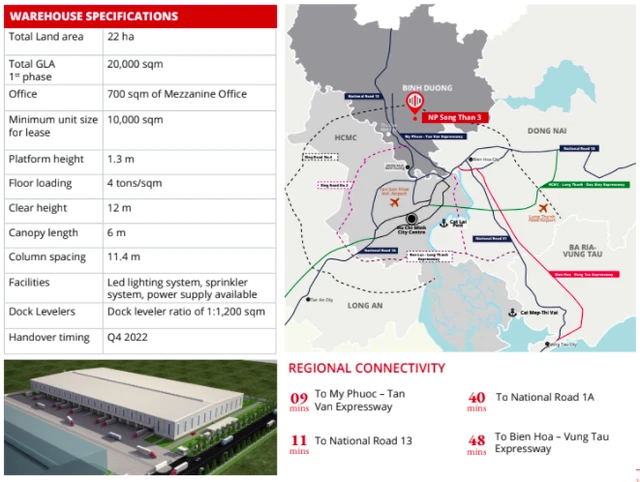

With the above point, Gaw NP Industrial soon plans to invest about 200-500 million USD to expand the land bank in Vietnam for the next 12-18 months. Not only in the North, Gaw NP Industrial has also been regretting 2 projects in the South, which are expected to launch in the next 6 months in Binh Duong, Dong Nai.

The fact that more and more large-scale FDI projects expand investment capital proves that foreign enterprises are feeling confident with the economic recovery starting from the end of 2021. With the improved infrastructure, the Across the country, the North Central region and the Mekong Delta have a lot of potential for industrial real estate to make a strong breakthrough along with the recovery of the economy, Gaw NP Industrial emphasized that it will not miss the opportunity. this association.

In particular, the Company’s land funds are mainly concentrated in the North, because the infrastructure connection is closer to the current auxiliary supply source, which is China. In addition, Gaw NP Industiral is also looking for locations near seaports and airports, especially with infrastructure development… which focuses on neighboring provinces of Ho Chi Minh City.

Sharing more deeply about the potential of Vietnam’s industrial real estate market, Gaw NP Industiral emphasized: Good macro indicators, the government’s openness, and a rapidly growing middle class are the foundation to attract more foreign direct investments. With an impressive economic growth rate, Vietnam is witnessing an explosion of modern retail means such as e-commerce and a wave of foreign investment in production facilities. From there, driving the demand for high-quality industrial real estate is expected to reach new heights, especially in the near future when all international flights will be opened.

“It is not by chance that all the factories displayed in neighboring countries have been relocated to the S-shaped country. Because, Vietnam currently has a golden population structure with 60% of the population being very young, high productivity and hard work Vietnam also benefits from its strategic geographical position in the heart of East Asia, home to several large and vibrant economies and is a member of many Agreements big trade,” said the representative.

Although the rapidly increasing strain of Delta Covid-19 has had an impact on manufacturing in Ho Chi Minh City – the commercial center of Vietnam, the big picture story is of Vietnam becoming a preferred destination. of foreign investment is unlikely to change. Even with the forecasts cut, economists still believe the country will bounce back.

In fact, Vietnam has been the choice of many giants in the electronics, footwear and clothing industries over the past decade. With cheap labor costs, developed infrastructure and investment attraction policies, Vietnam has attracted the attention of major global brands such as Samsung, Foxconn, Nike, Adidas, Gap, Levis, Luxshare, Pegatron .

However, there is one inadequacy that makes the parties wonder, according to Mr. Nhan, is that the land issue is quite specific: “Many foreign partners are afraid of the project implementation time, not to mention the current price of land is falling. increase”.

Particularly, Gaw NP Industrial, from the beginning, the Company has focused on developing the legal team, actively implementing in many different localities. At the same time, Gaw NP Industrial also affirmed not to compete in areas where the land price is too unreasonable, because this will affect the output of the Company’s partners. Despite the increase in land prices, the profitability ratio according to Mr. Nhan revealed is still attractive with somewhere in the double digits. Legally, it is a good sign that the Company’s project occupancy rate in the North has reached 100% recently, thanks to the Northern government’s flexibility in supporting policies, especially for foreign partners. .

In general, this Hong Kong fund is investing in Vietnam about 2 billion USD for the industrial real estate segment, including the Data Center project with an investment of 200 million USD.

Tri Tuc

By Business and Marketing